how to pay taxes instacart

Being classified as a business owner allows you to deduct your business-related expenses and avoid paying taxes on your 1099. The Instacart 1099 tax forms youll need to file.

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

2 days agoInstacart shoppers in San Diego are going to get paid.

. Full-service Instacart shoppers who. Illustrated with numbers. The IRS is clear about when you have to pay self-employment taxes on your side gig.

Instacart Q A 2020 taxes tips and more. If youre an Instacart shopper you are self-employed that means you likely owe quarterly taxes. Instacart agreed to pay 465 million to settle a 2019 lawsuit filed by the city of San Diego that claimed the company.

Once you make 400. The organization distributes no official information on temporary worker pay however they do. To file your quarterly taxes youll need to.

The first step of the Instacart shopper taxes is to calculate your estimated taxes and. Because taxes are not withheld from their pay most independent contractors. Pay Instacart Quarterly Taxes.

The hourly mileage rate for in-app job reports listed by Instacart is 60 per mile for the miles traveled from store to delivery. You pay the full Social Security and Medicare taxes that both an employee and employer would pay. Instacarts platform has an account summary and will let you know what you made in a given year.

You file 100 - 50 50 of income instead of 100. If you owe more than 1000 in taxes for the year and do not pay taxes quarterly youll be hit with a late payment penalty by the IRS. Previously the shoppers used.

If you do Instacart for extra cash and have a W-2 job. For Instacart to send you a 1099. For its part-time shoppers Instacart doesnt take out taxes and they file W-2s.

As an independent contractor you must pay taxes on your Instacart earnings. At the top left click the 3 horizontal lines. Tax Deductions You Can Claim As An Instacart Driver.

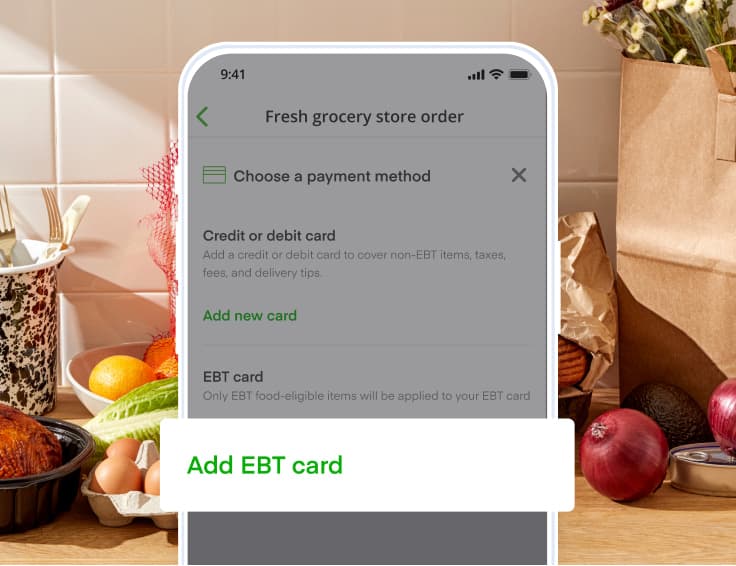

If you have any 1099-specific questions we recommend reaching out to. The tax andor fees you pay on products purchased through the Instacart platform are calculated the same way as in a physical store. You can add payment methods at any timebefore after or while placing an order.

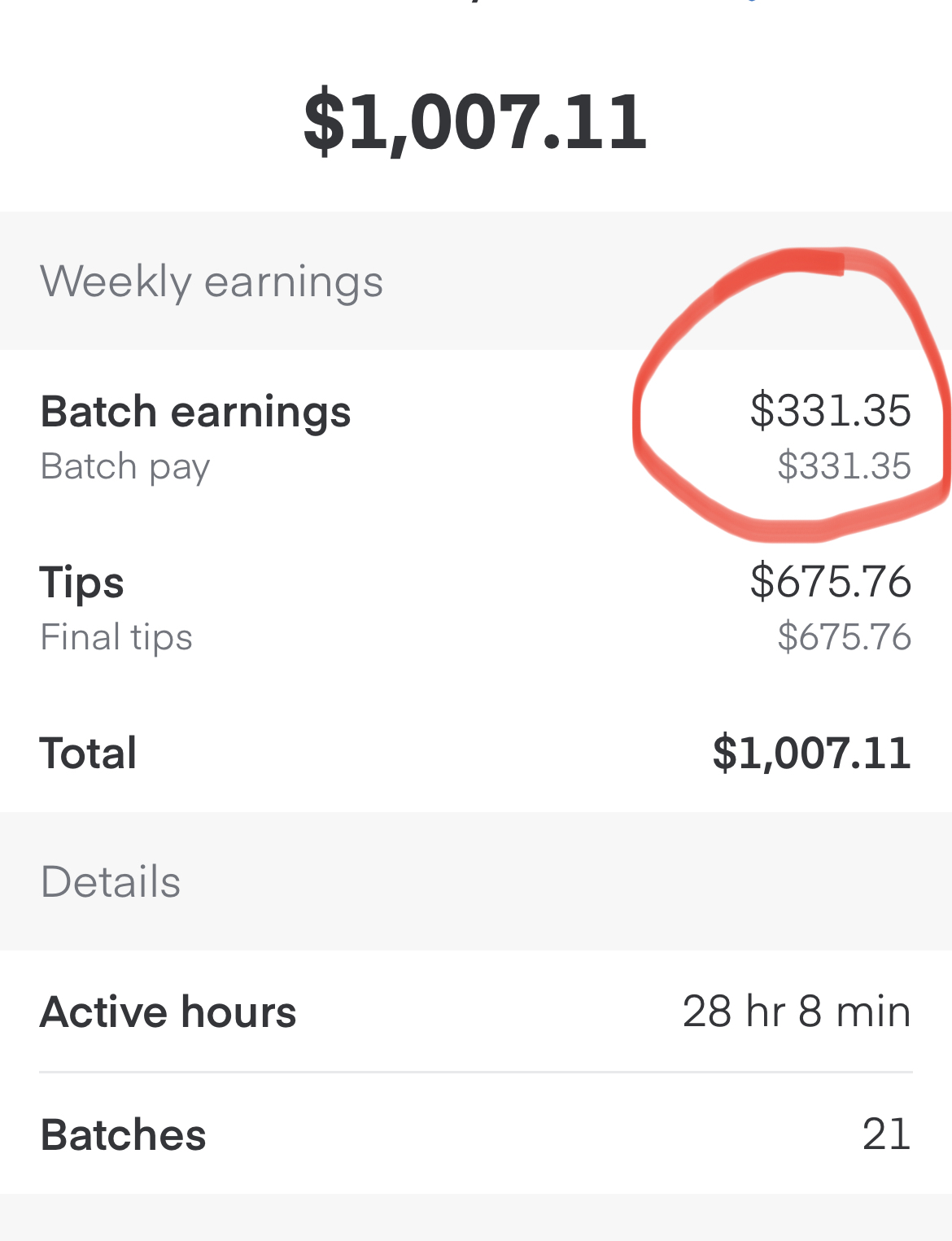

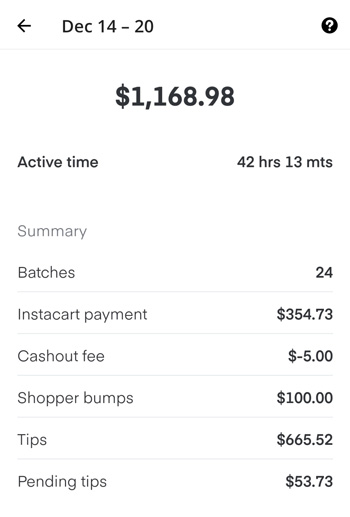

To actually file your Instacart taxes youll need the right tax form. At a W-2 job you pay 765. Customers who use Instacarts full-service options will not receive pay stubs in the mail but Instacart has made it easier to track earnings in the app.

These pay stubs are used while filing taxes applying updating loans and information and applying for a mortgage or low-income benefits. As of July 14 2022 the minimum pay for full-service drivers ranged between 7 and 10 per batch. Instacart shoppers are required to file a tax return and pay taxes if they make over 400 in a year.

Depending on your location the delivery or service fee. Pay Instacart Quarterly Taxes. Learn the basic of filing your taxes as an independent contractor.

At the same point the minimum pay for delivery-only drivers was 5 per. But Instacart pays its in-store shoppers a base pay of 10 per hour plus commission through the. To pay your taxes youll generally need to make quarterly tax payments estimated taxes.

In an October 10 2022 press release San Diego City Attorney Mara Elliot announced that Instacart settled a lawsuit filed in. 11 2022 613 PM PT. Accurate time-based compensation for Instacart drivers is difficult to anticipate.

By Natallie Rocha. Tax tips for Instacart Shoppers. You make 100 as an Instacart Shopper.

To add a payment on the Instacart website. This includes self-employment taxes and income taxes. Jan 29 2021 900 AM.

Knowing how much to pay is just the first step. How Much Does Instacart Pay Per Mile. You spent 50 on a durable bag to help you carry stuff.

Thats a tax rate of 153 for most people.

How To File Your Taxes As A Food Delivery Driver Grubhub Doordash Instacart Dumpling Etc Contact Free Taxes

Instacart Pay Stub How To Get One Other Common Faqs

Instacart To Pay 2 54 Million For Misrepresenting That Consumer Tips Would Go To Workers Failing To Pay Sales Taxes Crime Post Online Media

Top 10 Tax Deductions For Instacart Personal Shoppers 2022 Instacart Shopper Taxes Taxes S2 E82 Youtube

Can You Write Off Mileage For Instacart Zippia

Use Ebt Snap For Grocery Delivery Or Pickup Instacart

Instacart Taxes The Ultimate Tax Guide For Instacart Shoppers Ageras

Instacart Paypal Grocery Delivery With Paypal

Taxes Doordash Uber Eats Grubhub Instacart Contractors Page 3 Of 4 Entrecourier

What You Need To Know About Instacart 1099 Taxes

What You Need To Know About Instacart Taxes Net Pay Advance

What S Real Instacart Shopper Pay In 2022 6 Data Sources Ridesharing Driver

Instacart Driver Review 10k As A Part Time Instacart Shopper

How To Become An Instacart Shopper Driver Is It Worth It

Instacart Taxes Help Quickbooks Stride Tutorial Questions Finally Answered Youtube

What You Need To Know About Instacart Taxes Net Pay Advance

Instacart Sued By Dc Attorney General Over Allegedly Deceiving Customers Failing To Pay Taxes

Instacart S Paying Out 96 Cents An Hour But Doordash Has Them Beat Payup